BitMine Immersion Technologies Inc. has become the top foreign equity pick among South Korean retail investors, who continue to be drawn to the kind of high-risk, high-reward opportunities on offer in crypto.

Backed by Peter Thiel’s Founders Fund, BitMine is a US-listed Bitcoin miner that recently transitioned from Bitcoin mining to operating as a digital-asset treasury — a listed entity designed primarily to accumulate and hold cryptocurrency. The company now boasts the largest Ether treasury with $3.6 billion worth of the token, according to data compiled by strategicethreserve.xyz.

Top-5 Overseas Securities Koreans Bought Since July

Source: Korea Securities Depository

Retail investors in Korea have poured a net $259 million into BitMine shares since the start of July, making it the most purchased foreign security during that period, according to the Korea Securities Depository.

The surge underscores the speculative fervor that continues to grip South Korea’s retail base. Roughly a third of the nation’s population — about 18 million people — are active in digital-asset markets, drawn to everything from leveraged crypto exchange-traded funds to newly listed firms like stablecoin issuer Circle Internet Financial Ltd.

BitMine hopes to emulate the business model popularized by Michael Saylor’s Strategy, albeit with a focus on Ether instead of Bitcoin. The move places it among a growing group of digital-asset treasury firms emerging across the crypto landscape, with holdings ranging from Binance-linked BNB to Litecoin.

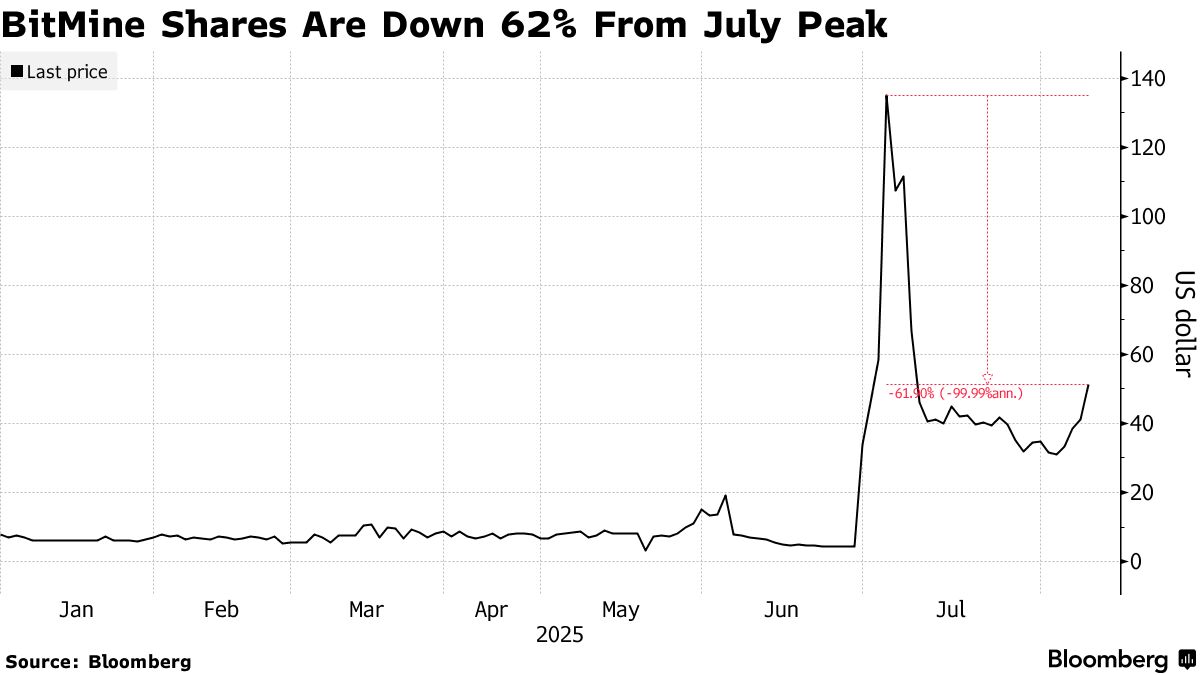

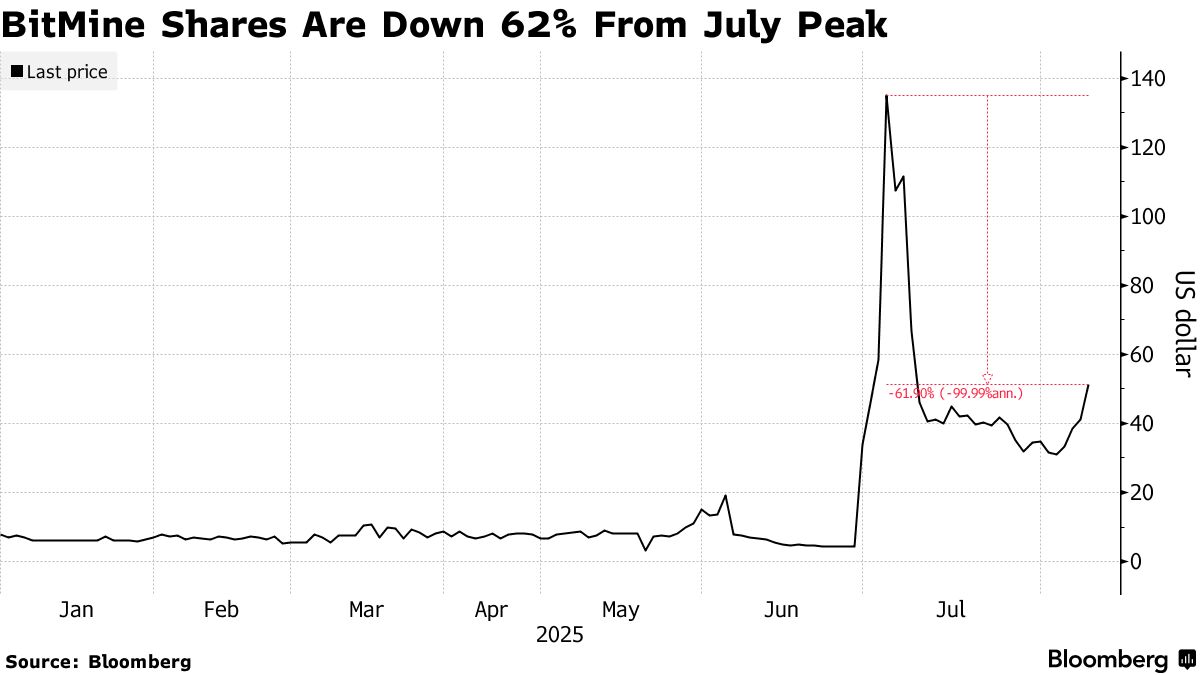

Volatility remains a hallmark of such stocks — and BitMine is no exception. Its shares surged more than 3,000% to a July peak after the company announced its plan to stockpile Ether, then plunged 62%.

Backed by Peter Thiel’s Founders Fund, BitMine is a US-listed Bitcoin miner that recently transitioned from Bitcoin mining to operating as a digital-asset treasury — a listed entity designed primarily to accumulate and hold cryptocurrency. The company now boasts the largest Ether treasury with $3.6 billion worth of the token, according to data compiled by strategicethreserve.xyz.

Top-5 Overseas Securities Koreans Bought Since July

Source: Korea Securities Depository

Retail investors in Korea have poured a net $259 million into BitMine shares since the start of July, making it the most purchased foreign security during that period, according to the Korea Securities Depository.

The surge underscores the speculative fervor that continues to grip South Korea’s retail base. Roughly a third of the nation’s population — about 18 million people — are active in digital-asset markets, drawn to everything from leveraged crypto exchange-traded funds to newly listed firms like stablecoin issuer Circle Internet Financial Ltd.

BitMine hopes to emulate the business model popularized by Michael Saylor’s Strategy, albeit with a focus on Ether instead of Bitcoin. The move places it among a growing group of digital-asset treasury firms emerging across the crypto landscape, with holdings ranging from Binance-linked BNB to Litecoin.

Volatility remains a hallmark of such stocks — and BitMine is no exception. Its shares surged more than 3,000% to a July peak after the company announced its plan to stockpile Ether, then plunged 62%.

Comments

Post a Comment